Are Cryptocurrency Gains Taxable In Canada

Sell or make a gift of cryptocurrency. In the US cryptocurrencies like bitcoin are treated as property for tax purposes.

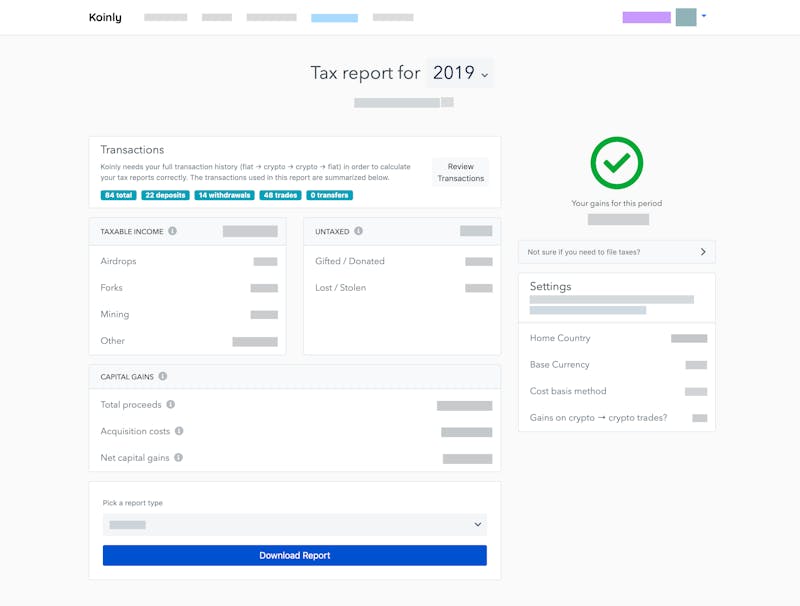

Calculating Crypto Taxes In Canada With The Superficial Loss Rule Koinly

2020 Long-Term Capital Gains Tax Rates.

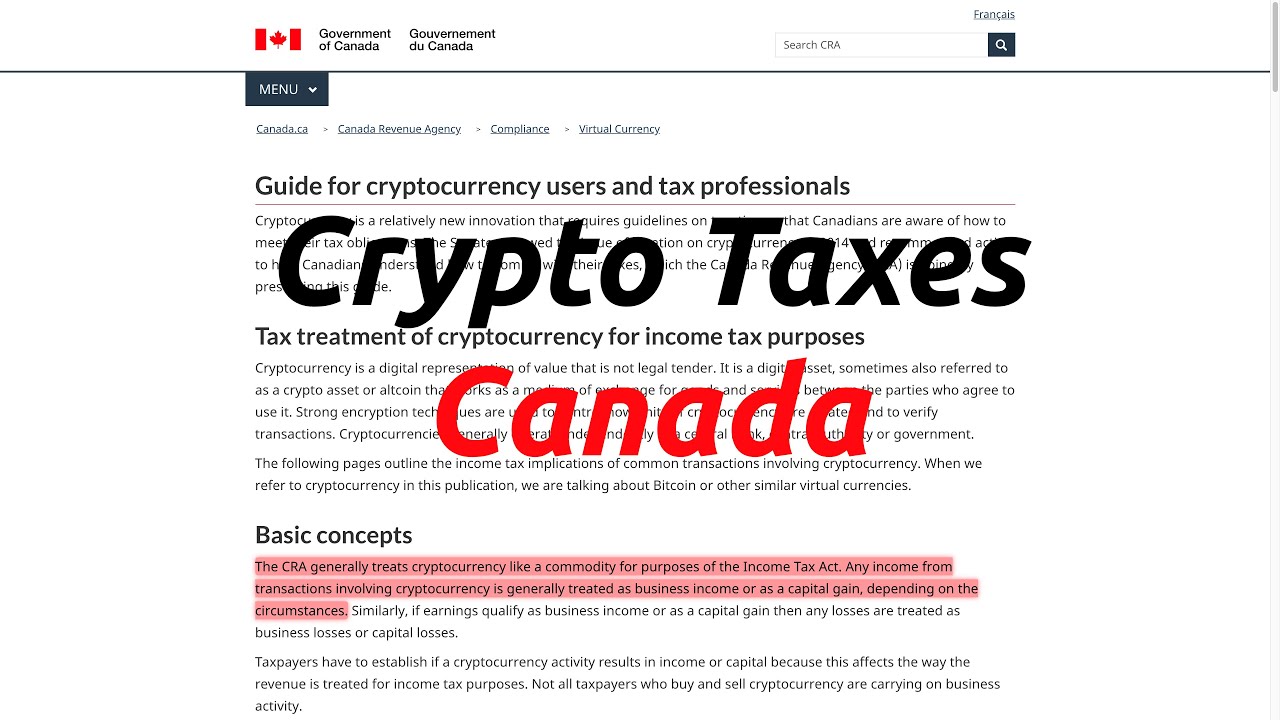

Are cryptocurrency gains taxable in canada. Income - Head of Household. Cryptocurrency is considered a digital asset in the CRAs eyes. Any gains or loses arising from an individuals cryptocurrency portfolio are thus taxed in the same manner as any other commodity investment in Canada.

Capital assets are taxed whenever they are sold at a profit. In Canada 50 of your capital gains are taxable. The Basics of Crypto Taxes.

When you realize a capital gain. Imagine that you accept a digital currency. Additionally the CRA also taxes any gains over 200 you make during currency conversions as capital gains.

In general simply possessing or holding a cryptocurrency is not taxable. You would have to report a capital gain of 1000 50 of 2000 which would be added to your income and taxed at your marginal tax rate. For example if you purchased 200 bitcoins for 50000 but sold them six months later for 62400 you would have to declare a capital gain of 12400.

In Canada Crypto is taxed as either capital gains or as income tax depending on whether your activity with cryptocurrency is considered to be as a business or not. 100 of business income is taxable whereas only 50 of capital gains are taxable. Cryptocurrency is taxed in Canada as either capital gains or as income tax depending on whether your activity with cryptocurrency is considered to be as a business or not.

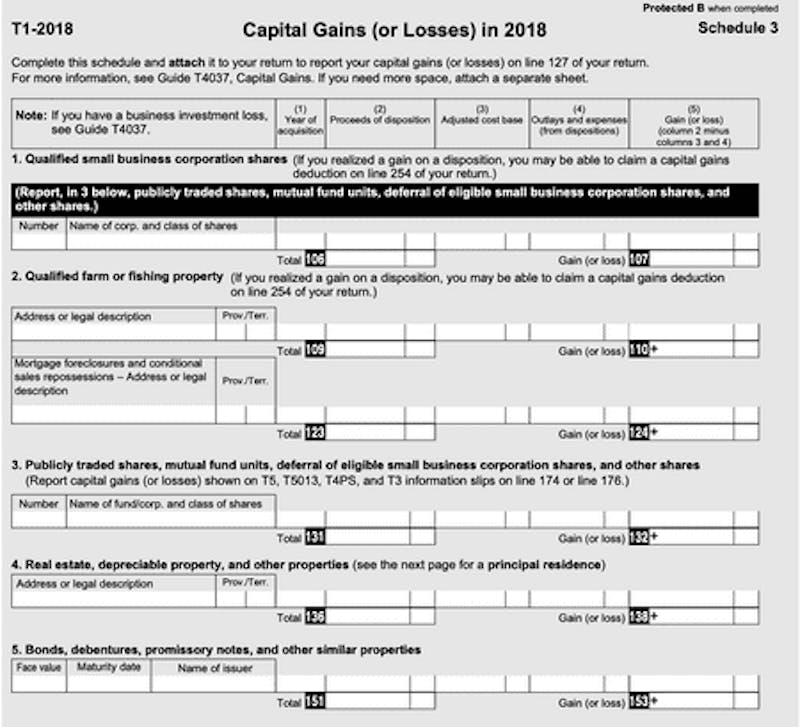

Any capital losses resulting from the sale can only be offset against capital gains. You may need to file form T1135 and will need to report income when you do trade so we recommend reading this post. The portion of the Canada Revenue Agencys tax code regarding securities exchanges applies to these transactions.

100 of business income is taxable whereas only 50 of capital gains are taxable. If you have done so you will need to work out the capital gains for each transaction. Capital gains from the sale of cryptocurrency are generally included in income for the year but only half of the capital gain is subject to tax.

So of the 40000 profit you made upon selling you would have to report 20000 as income for your taxes on Section 5 on Schedule 3 of your income tax return. If you own cryptocurrency but havent sold or traded it you dont need to report income on your return. What is Cryptocurrency Worth.

That means it is subject to capital gains tax which has a much better tax treatment than income. Just like other forms of property like stocks bonds and real-estate you incur capital gains and capital losses on your cryptocurrency investments when you sell trade or otherwise dispose of your crypto. This is called the taxable capital gain.

The CRA states clearly that each individual cryptocurrency is a separate asset and should be valued separately. 50 of the gains are taxable and added to your income for that year. If you sold or traded cryptocurrency even for other cryptocurrency you have a taxable event and must report it.

If youre running a business 100 of your crypto-related business income is. Lets say you bought a cryptocurrency for 1000 and sold it later for 3000. Cryptocurrency is taxed in Canada as either capital gains or as income tax depending on whether your activity with cryptocurrency is considered to be as a business or not.

To figure out the value of a transaction you must use a reasonable record and keep records to show you figured out the value. In Canada youre only taxed on 50 of realized capital gains. Capital gains are realized when you dispose of an asset and unrealized when you hold onto it.

For those new to investing in general its important to know that you just have to pay tax on HALF of the capital gain. You cannot use them to reduce income from other sources such as employment income. Canadas guide for cryptocurrency users and tax professionals.

All the same rules apply. Cryptocurrency is taxed like any other commodity in Canada. Instead the Canadian Revenue Agency CRA treats Bitcoin and other crypto assets as a commodity equivalent to investment property such as a stock ownership for tax purposes.

Selling cryptocurrency such as bitcoin for fiat currency eg. Income - Married Filing Jointly. If the reasonable value fair market value of the gifts and awards you give your employee is more than 500 the amount over 500 will be taxable.

A capital gain occurs when you earn money from selling or exchanging crypto that has increased in value. When you purchase goods or services with cryptocurrency and the amount of crypto you spend has gained. For example if you receive cryptocurrency gifts with a total reasonable value of 650 there will be a tax implication on the excess 150 650-500.

If youre a cryptocurrency investor in Canada youre subject to capital gains and losses just as with other kinds of currency trading stocks or mutual funds. Trade or exchange cryptocurrency including disposing of one cryptocurrency to get another cryptocurrency. When you use cryptocurrency to pay for goods or services the CRA treats it as a barter transaction.

CAD is considered a taxable event in Canada which is similar to most other countries. However you trigger tax consequences when you do any of the following.

How Much Is The Queen S Net Worth In Cryptocurrency In 2021 Blockchain Cryptocurrency Bitcoin

Cryptocurrency Taxes In Canada Cointracker

Declare Your Bitcoin Cryptocurrency Taxes In Canada Cra Koinly

Https Mixm Io Investment Advice Ways To Earn Money Cryptocurrency Trading

Crypto Taxes In Canada Adjusted Cost Base Explained

Canada Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda

Guide To Bitcoin Crypto Taxes In Canada Updated 2020

Crypto Taxes In Canada Adjusted Cost Base Explained

Another Year Of Highs And Lows For Crypto Blockchain Technology Blockchain Securities And Exchange Commission

5 Ways To Buy Bitcoin In The United Kingdom Buy Bitcoin Buy Cryptocurrency Bitcoin

Canadian Cryptocurrency Tax Reporting For Exchanges And Users Taxbit Blog

Uk Govt Unveils Cryptocurrency Tax Guidelines For Individuals Her Majestys Revenue And Customs Hmrc Yesterday Released Apolicy Pap Investing Bitcoin Tax App

Walmart S Canada Branch Plans To Develop Blockchain Based Delivery Tracking System Walmart Walmart Bit Blockchain Tracking System Bitcoin Price

Cryptocurrency Taxes In Canada The 2021 Guide Koinly

How To Buy Bitcoin What Is Bitcoin Mining Bitcoin Mining Buy Bitcoin

Declare Your Bitcoin Cryptocurrency Taxes In Canada Cra Koinly

Post a Comment for "Are Cryptocurrency Gains Taxable In Canada"